Definition: Expanded Accounting Equation

What is the Expanded Accounting Equation?

The Expanded Accounting Equation is the Accounting Equation with more detail. The Expanded Accounting Equation generally shows Equity equaling Contributions minus Withdrawals plus Income minus Expenses. In order to understand the Expanded Accounting Equation, you need to understand the simple form of the Accounting Equation.

The Expanded Accounting Equation and the Accounting Equation summarizes the relationship of property and ownership, such that the total amount of property in a business equals the total amount of ownership of the property. A simple form of the Accounting Equation is Property = Ownership. Since property can be owned by owners and lenders, the Accounting Equation can be written as Property = Third-Party Ownership + Owner Ownership. The following figure summarizes the Accounting Equation:

The Expanded Accounting Equation and the Accounting Equation summarizes the relationship of property and ownership, such that the total amount of property in a business equals the total amount of ownership of the property. A simple form of the Accounting Equation is Property = Ownership. Since property can be owned by owners and lenders, the Accounting Equation can be written as Property = Third-Party Ownership + Owner Ownership. The following figure summarizes the Accounting Equation:

Here is an example of using the Accounting Equation. Let's say a business has $10,000 of cash property, where $4,000 of the cash was obtained from a loan and $6,000 is owned by the owners of the business. The Accounting Equation would calculate this as:

Accounting Equation

Property = Third-Party + Owner

$10,000 = $4,000 + $6,000

$10,000 = $10,000 (balanced)

In formal accounting terms, the Accounting Equation uses Assets as property, Liabilities as third-party ownership and Equity as owner ownership. This gives us the formal version of the Accounting Equation:

Accounting Equation

Property = Third-Party + Owner

$10,000 = $4,000 + $6,000

$10,000 = $10,000 (balanced)

In formal accounting terms, the Accounting Equation uses Assets as property, Liabilities as third-party ownership and Equity as owner ownership. This gives us the formal version of the Accounting Equation:

If we use the same example of the Accounting Equation above, we get:

Accounting Equation

Assets = Liabilities + Equity

$10,000 = $4,000 + $6,000

$10,000 = $10,000 (balanced)

The Expanded Accounting Equation gives us more detail about the Equity portion of ownership. Equity is equal to what an owner invests into their company, minus what the owner takes out, plus any profit they make. Profit is equal to income minus expenses. Let's say that the owner in the preceding example invested $1,500 cash into their business and withdrew $500. Let's also say the business made a profit of $5,000, $10,000 of income and $5,000 of expenses. The Expanded Accounting Equation would show this as:

Expanded Accounting Equation

Assets = Liabilities + Contributions - Withdrawals + Income - Expenses

$10,000 = $4,000 + $1,500 - $500 + $10,000 - $5,000

$10,000 = $4,000 + $6,000

$10,000 = $10,000 (balanced)

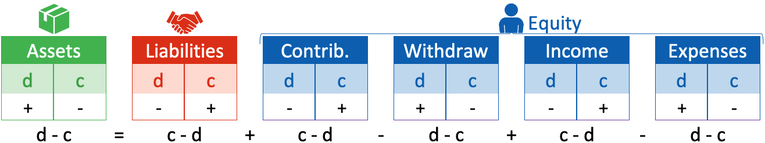

The formal version of the Expanded Accounting Equation and the Accounting Equation use account balances to calculate a value for Assets, Contributions, Withdrawals, Income and Expenses. The following figure shows the Expanded Accounting Equation - "d" means "debit", "c" means "credit", "+" means an increase and "-" means a decrease.

Accounting Equation

Assets = Liabilities + Equity

$10,000 = $4,000 + $6,000

$10,000 = $10,000 (balanced)

The Expanded Accounting Equation gives us more detail about the Equity portion of ownership. Equity is equal to what an owner invests into their company, minus what the owner takes out, plus any profit they make. Profit is equal to income minus expenses. Let's say that the owner in the preceding example invested $1,500 cash into their business and withdrew $500. Let's also say the business made a profit of $5,000, $10,000 of income and $5,000 of expenses. The Expanded Accounting Equation would show this as:

Expanded Accounting Equation

Assets = Liabilities + Contributions - Withdrawals + Income - Expenses

$10,000 = $4,000 + $1,500 - $500 + $10,000 - $5,000

$10,000 = $4,000 + $6,000

$10,000 = $10,000 (balanced)

The formal version of the Expanded Accounting Equation and the Accounting Equation use account balances to calculate a value for Assets, Contributions, Withdrawals, Income and Expenses. The following figure shows the Expanded Accounting Equation - "d" means "debit", "c" means "credit", "+" means an increase and "-" means a decrease.

The term "debit" refers to the act of "receiving" and the term "credit" refers to the act of "giving".

If you want to understand the meanings of debit and credit, check out the definition of debit and credit.

If you want to understand the meanings of debit and credit, check out the definition of debit and credit.

The Expanded Accounting Equation & The Balance Sheet

The Expanded Accounting Equation is used to create a business's Balance Sheet statement. The Balance Sheet statement details a business's assets and liabilities, but does not detail any equity because equity is shown using the business's Profit/Income statement and Owner Equity statement. It is called a Balance Sheet statement because it uses the Expanded Accounting Equation to calculate the equality between property and ownership. These two values must balance (equal) one another or a mistake would have been made. In the Expanded Accounting Equation, every cent of property and ownership must be accounted for and must equal one another.

Continue Learning in an Interactive-Accounting Textbook

Over 4+ Hours of Free Lessons

The Addictive Accounting training course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

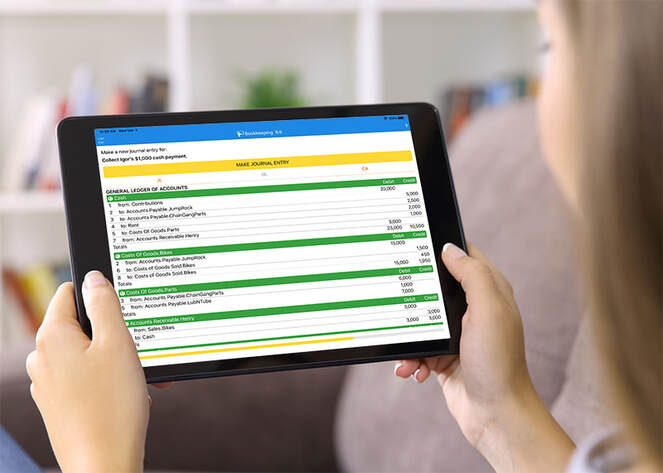

Practice the Expanded Accounting Equation in a Simulator

Rather than just read about the expanded accounting equation, practice the expanded accounting equation in a hands-on accounting simulation. Learn more about our accounting simulation app and see what you can learn for free in the Addictive Accounting course.