Definition: Credit and Debit

What are Credits and Debits?

The terms “debit” and “credit” are used to record bookkeeping journal entries. The terms debit and credit are ancient accounting terms that describe the relationship of property to ownership. Debit refers to "debtor" and credit refers to "creditor". Since a business is not a person, it cannot own anything, so it is always indebted to its creditors. Its creditors are generally either third-parties (banks and vendors) or the owners of the business.

The relationship between the property a business possesses and the ownership of that property is represented using the Accounting Equation:

The relationship between the property a business possesses and the ownership of that property is represented using the Accounting Equation:

Or in accounting terms:

A business is always a debtor to its creditors who are either third parties or owners.

Here is a simple example. Let's say a business has $6,000 of cash property, $2,000 of which it received from a bank loan. Since the business cannot own any of the cash, the bank owns $2,000 and the owners of the business own $4,000. In other words the business is indebted to its creditors for $6,000.

Assets = Liabilities + Equity

$6,000 = $2,000 + $4,000

$6,000 = $6,000 (balanced)

Since the equation balances, all the property (debtor) and ownership of the property (creditor) has been accounted for. We can write this as:

Debtor (business) = Creditors (third parties and owners)

This is commonly referred in accounting as the number one rule which states:

Debits = Credits

This makes sense if you understand that a business is not a person and cannot own anything, therefore, everything a business receives is owed to its creditors and one of those creditors is its owners. This simple fact is probably the most misunderstood fundamental principle of accounting.

Property and ownership transactions are recorded in a Journal in the order they happen using debits and credits. These entries are sorted to the General Ledger of Accounts and Chart of Accounts.

To help you understand the use of debit and credit, it helps to remember the following:

Assets = Liabilities + Equity

$6,000 = $2,000 + $4,000

$6,000 = $6,000 (balanced)

Since the equation balances, all the property (debtor) and ownership of the property (creditor) has been accounted for. We can write this as:

Debtor (business) = Creditors (third parties and owners)

This is commonly referred in accounting as the number one rule which states:

Debits = Credits

This makes sense if you understand that a business is not a person and cannot own anything, therefore, everything a business receives is owed to its creditors and one of those creditors is its owners. This simple fact is probably the most misunderstood fundamental principle of accounting.

Property and ownership transactions are recorded in a Journal in the order they happen using debits and credits. These entries are sorted to the General Ledger of Accounts and Chart of Accounts.

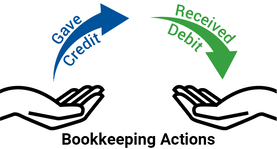

To help you understand the use of debit and credit, it helps to remember the following:

In order to be a creditor, you must “give” something to someone who promises repayment.

In order to be a debtor, you must “receive” something from someone with a promise of payment.

In other words, you can replace any occurrence of the bookkeeping term “debit” with “received” or “received from” and the term “credit” with “given” or “given to”.

The bookkeeping term “credit” means the ACT OF GIVING.

The bookkeeping term “debit” means the ACT OF RECEIVING.

The left column of an account's ledger always records debits as the ACT OF RECEIVING, and the right column of an account's ledger always records credits as the ACT OF GIVING.

Pay special attention to the word “act” because in bookkeeping, the term “debit” does not directly mean “in debt,” it means the act of “having received.” Likewise, “credit” does not directly mean “creditor”, it means the act of “having given”. Interpretation of who owes who is done using specific accounts. The amount owed a creditor is the difference between what they give and receive back. The amount a debtor owes is the difference between what they receive and give back.

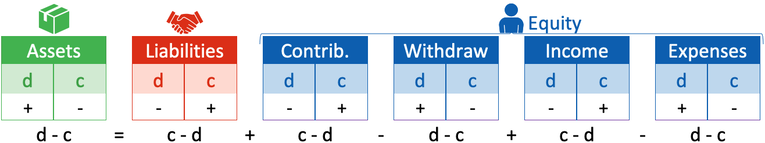

Let’s apply the abstract meanings of debtor and creditor to the following Expanded Accounting Equation:

Pay special attention to the word “act” because in bookkeeping, the term “debit” does not directly mean “in debt,” it means the act of “having received.” Likewise, “credit” does not directly mean “creditor”, it means the act of “having given”. Interpretation of who owes who is done using specific accounts. The amount owed a creditor is the difference between what they give and receive back. The amount a debtor owes is the difference between what they receive and give back.

Let’s apply the abstract meanings of debtor and creditor to the following Expanded Accounting Equation:

Let's calculate each account's balance using debits and credits.

The total amount of property in the possession of a business will equal the amount it received over time minus the amount it gave back.

Assets = received - given

or

Assets = debits - credits

In common accounting, the rule is Assets increase with debits and decrease with credits.

Liabilities and Equity accounts are recorded from the perspective of the creditor. For example, the amount a business owes a vendor will equal the amount the vendor gave the business minus the amount the vendor received back. Note the perspective. A vendor's account is recorded as "vendor gave" and "vendor received" and the difference is what the business owes the vendor.

Liabilities = gave - received

or

Liabilities = credits - debits

In common accounting, the rule is Liabilities increase with credits and decrease with debits.

We can keep going. The amount an owner directly contributes to their business is equal to the amount they gave minus the amount they received back. Remember perspective. An owner is a creditor to their business, therefore, the difference between what the owner gave and received back is what the business owes the owner.

Contributions = gave - received

or

Contributions = credits - debits

In common accounting, the rule is Contributions increase with credits and decrease with debits.

The amount an owner withdrawals from their business is equal to the amount they received back minus the amount they gave. Make sure to pay attention to perspective. It is recorded from the perspective of the owner, as the actions of the owner on the business.

Withdrawals = received - gave

or

Withdrawals = debits - credits

In common accounting, the rule is Withdrawals increase with debits and decrease with credits.

Income is equal to the amount a business gave its customers minus the amount its customers returned as refunds. It represents incoming payments for work given.

Income = gave - received

or

Income = credits - debits

In common accounting, the rule is Income increase with credits and decrease with debits.

Expenses are equal to the amount of assets leaving the business. When assets leave the business, the owner receives them as a decrease of equity. You can think of Expenses as an exodus of property that the owner accepts as a decrease of ownership.

Expenses = received - given

or

Expenses = debits - credits

In common accounting, the rule is Expenses increase with debits and decrease with credits.

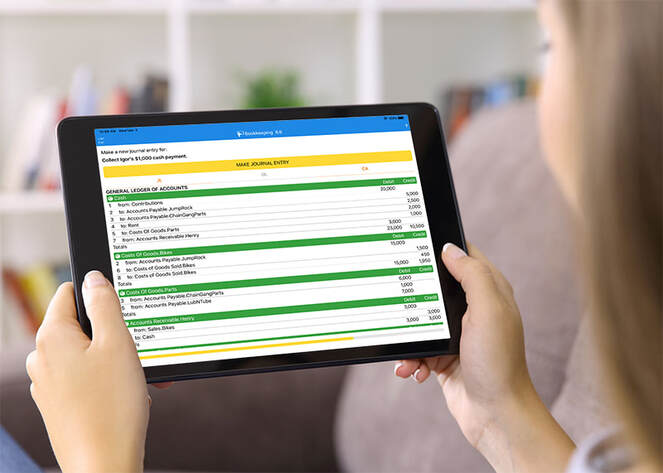

This quick explanation is a crash course on these terms. To really understand them, why not keep learning! In order to help you learn quickly, we created a simplified accounting simulator that teaches you step-by-step how journal entries are made, sorted and placed in financial statements. You can start learning right now. Start learning with our FREE high school college accounting bookkeeping prep course.

The total amount of property in the possession of a business will equal the amount it received over time minus the amount it gave back.

Assets = received - given

or

Assets = debits - credits

In common accounting, the rule is Assets increase with debits and decrease with credits.

Liabilities and Equity accounts are recorded from the perspective of the creditor. For example, the amount a business owes a vendor will equal the amount the vendor gave the business minus the amount the vendor received back. Note the perspective. A vendor's account is recorded as "vendor gave" and "vendor received" and the difference is what the business owes the vendor.

Liabilities = gave - received

or

Liabilities = credits - debits

In common accounting, the rule is Liabilities increase with credits and decrease with debits.

We can keep going. The amount an owner directly contributes to their business is equal to the amount they gave minus the amount they received back. Remember perspective. An owner is a creditor to their business, therefore, the difference between what the owner gave and received back is what the business owes the owner.

Contributions = gave - received

or

Contributions = credits - debits

In common accounting, the rule is Contributions increase with credits and decrease with debits.

The amount an owner withdrawals from their business is equal to the amount they received back minus the amount they gave. Make sure to pay attention to perspective. It is recorded from the perspective of the owner, as the actions of the owner on the business.

Withdrawals = received - gave

or

Withdrawals = debits - credits

In common accounting, the rule is Withdrawals increase with debits and decrease with credits.

Income is equal to the amount a business gave its customers minus the amount its customers returned as refunds. It represents incoming payments for work given.

Income = gave - received

or

Income = credits - debits

In common accounting, the rule is Income increase with credits and decrease with debits.

Expenses are equal to the amount of assets leaving the business. When assets leave the business, the owner receives them as a decrease of equity. You can think of Expenses as an exodus of property that the owner accepts as a decrease of ownership.

Expenses = received - given

or

Expenses = debits - credits

In common accounting, the rule is Expenses increase with debits and decrease with credits.

This quick explanation is a crash course on these terms. To really understand them, why not keep learning! In order to help you learn quickly, we created a simplified accounting simulator that teaches you step-by-step how journal entries are made, sorted and placed in financial statements. You can start learning right now. Start learning with our FREE high school college accounting bookkeeping prep course.

Continue Learning in an Interactive-Bookkeeping Textbook

Over 4+ Hours of Free Lessons

The Addictive Accounting training course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

Practice Credits and Debits in an Accounting Simulator

Rather than just read about debits and credits, learn and practice using debits and credits as a bookkeeper in a hands-on accounting simulation. Learn more about our accounting simulation app or see what you can learn for free in the Addictive Accounting course.