Definition: Accounts Receivable

What is Accounts Receivable?

Businesses keep track of customer debt using an Accounts Receivable account, abbreviated as AR. The Accounts Receivable account tracks what each customer receives when they purchase and also how much the customer pays when they make a payment on their purchase. The difference between what the customer received and what the customer paid is the customer's debt balance. If the customer has not paid enough, the customer owes the business. If the customer has paid exactly what they owe, the customer owes nothing. If the customer overpays, the business owes the customer.

An Accounts Receivable account should always have a debit or zero balance, but never a credit balance. Learn why.

An Accounts Receivable account should always have a debit or zero balance, but never a credit balance. Learn why.

Accounts Receivable is an Asset

The Accounts Receivable account is the parent account of all a business's individual customer child subaccounts. The total balance of the Accounts Receivable account equals the total amount that all the customers combined owe the business. In other words, the Account Receivable account represents the total amount of customer debt owed to the business. Since all the customer debt in the Accounts Receivable account can hopefully be collected and turned into cash, the Accounts Receivable account represents uncollected cash and cash is every business's most important asset, which why the Accounts Receivable account is recorded in bookkeeping as a subaccount of the main Assets account.

The Accounts Receivable account's full account name is:

Assets - Accounts Receivable - Customer Sam Smith's debt account

The Accounts Receivable account's full account name is:

Assets - Accounts Receivable - Customer Sam Smith's debt account

Accounts Receivable & Financial Statements

Since the Accounts Receivable account is an asset of every business. It is included on the business's Balance Sheet statement. The Balance Sheet shows the relationship between Assets, Liabilities and Equity. This relationship is referred to as the Accounting Equation.

The Accounts Receivable account is often confused with the Accounts Payable account. The difference is Accounts Receivable tracks customers and Accounts Payable tracks vendors. Learn more about Accounts Payable.

Continue Learning Accounts Receivable in an Interactive-Accounting Textbook

Over 4+ Hours of Free Lessons

The Addictive Accounting training course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

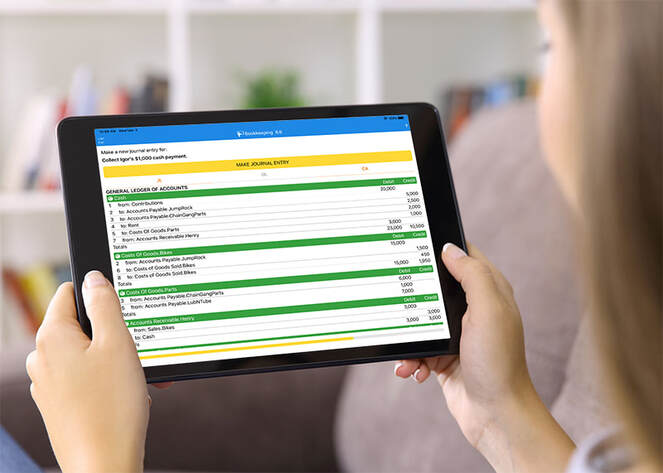

Practice Accounts Receivable in an Accounting Simulator

Rather than just read about accounts payable, learn and practice using the accounts payable account in a hands-on bookkeeping simulation. Learn more about our accounting simulation app and see what you can learn for free in the Addictive Accounting course.