Definition: Accounts Payable

What is Accounts Payable?

Businesses keep track of their debt with their vendors using an Accounts Payable account, abbreviated as AP. The Accounts Payable account tracks what each vendor gives the business as a creditor when the business makes a purchase from the vendor and also how much the business pays the vendor when it makes a payment. The difference between what the vendor gave the business and received from the business in the form of a payment is the business's debt balance with the vendor, or in other words, the vendor's credit balance with the business. If the business has not paid enough, the business owes the vendor. If the business has paid exactly what it owes, the business owes nothing. If the business overpays, the vendor owes the business.

Accounts Payable is a Liability

The Accounts Payable account is the parent account (group account) of all a business's individual vendor child subaccounts. The total balance of the Accounts Payable account equals the total amount the business owes all of its vendor's combined. In other words, the Account Payable account's balance represents the total amount of unpaid purchases. Since all the business's debt in the Accounts Payable account needs to be paid, the Accounts Payable account is recorded in bookkeeping as a subaccount of the main Liability account.

An example of a vendor's account, named ABC Wholesaler, in the Accounts Payable account is:

Liabilities -> Accounts Payable -> ABC Wholesaler

Here is an example of a journal entry showing a business purchasing $1,000 of inventory from ABC Wholesaler with a $500 cash payment:

Purchase

Liabilities -> Accounts Payable -> ABC Wholesaler gave/credit: $1,000

Assets -> Inventory received/debit: $1,000

Payment

Assets -> Cash gave/credit: $500

Liabilities -> Accounts Payable - ABC Wholesaler received/debit: $500

Since the vendor gave/credit $1,000 and only received/debit $500 from the business as a payment, the vendor's Account Payable account's balance has a credit balance of $500, meaning the vendor is still a creditor to the business for $500 of unpaid inventory.

The Accounts Payable account is often confused with the Accounts Receivable account. The difference is Accounts Payable tracks vendors and Accounts Receivable tracks customers.

An example of a vendor's account, named ABC Wholesaler, in the Accounts Payable account is:

Liabilities -> Accounts Payable -> ABC Wholesaler

Here is an example of a journal entry showing a business purchasing $1,000 of inventory from ABC Wholesaler with a $500 cash payment:

Purchase

Liabilities -> Accounts Payable -> ABC Wholesaler gave/credit: $1,000

Assets -> Inventory received/debit: $1,000

Payment

Assets -> Cash gave/credit: $500

Liabilities -> Accounts Payable - ABC Wholesaler received/debit: $500

Since the vendor gave/credit $1,000 and only received/debit $500 from the business as a payment, the vendor's Account Payable account's balance has a credit balance of $500, meaning the vendor is still a creditor to the business for $500 of unpaid inventory.

The Accounts Payable account is often confused with the Accounts Receivable account. The difference is Accounts Payable tracks vendors and Accounts Receivable tracks customers.

Accounts Payable & Financial Statements

Since the Accounts Payable account is an Liability of every business. It is included on the business's Balance Sheet statement. The Balance Sheet shows the relationship between Assets, Liabilities and Equity. This relationship is referred to as the Accounting Equation. Assets are property, liabilities are business debts, and equity is owner ownership. See the following figures:

Continue Learning Accounts Payable in an Interactive-Accounting Textbook

Over 4+ Hours of Free Lessons

The Addicting Accounting course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

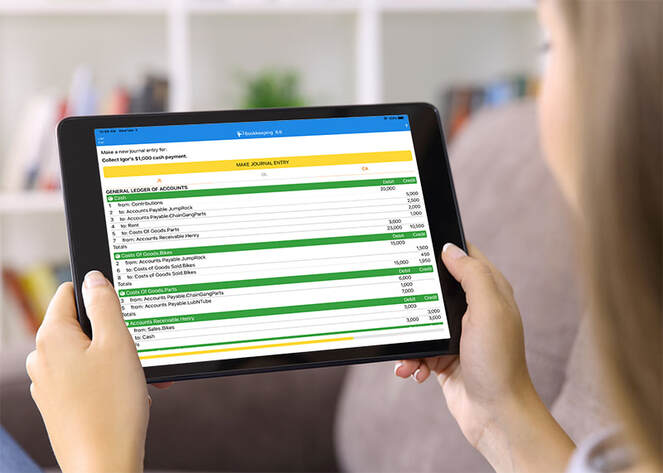

Practice Accounts Payable in a Bookkeeping Simulator

Rather than just read about accounts payable, practice using the Accounts Payable account in a hands-on accounting simulation. Learn more about our accounting simulation app and see what you can learn for free in the Addictive Accounting course.