Will this course help me use accounting software?

Learn to Utilize Your Accounting Software

Imagine trying to learn multiplication and division without having first learned how to add and subtract! It makes no sense to try and learn how to do multiplication and division without having first mastered addition and subtraction. The same concept is true for accounting software. If you learn the double-entry bookkeeping system, knowing how to efficiently use ANY professional accounting software will be so much easier!

The Addictive Accounting course was designed to teach the fundamentals of bookkeeping and accounting in high schools as an advanced prep course for college level accounting. Once you understand how financial journal entries are recorded in the Journal, General Ledger of Accounts and the Chart of Accounts, understanding your own accounting software will be a lot more straightfoward!

The Addictive Accounting course was designed to teach the fundamentals of bookkeeping and accounting in high schools as an advanced prep course for college level accounting. Once you understand how financial journal entries are recorded in the Journal, General Ledger of Accounts and the Chart of Accounts, understanding your own accounting software will be a lot more straightfoward!

A Basic Bookkeeping and Accounting Interactive Textbook

The Addicting Accounting training course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

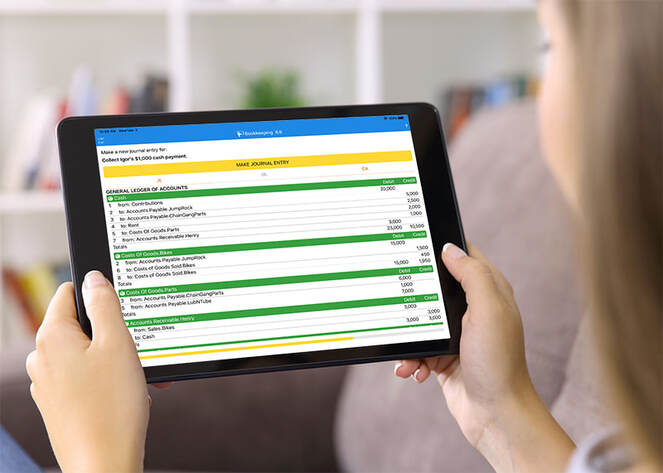

Learn Accounting in an Interactive Accounting Simulation

Rather than just read about bookkeeping and accounting, learn accounting by yourself hands-on in an accounting simulation. You will start by making simple journal entries and graduate to reconciling bank accounts. If you enjoy what you are learning, you can even learn how to record depreciation and close out accounting periods, such as closing out a business's accounts at the end of the year. Learn more about the accounting simulation app.

Learn About Debits and Credits and the Accounting Equation

The double-entry bookkeeping system records the actions of one person giving and another person receiving. What is traded is recorded using the terms "credit" and "debit". These terms are ancient terms and their meanings in modern bookkeeping refer to "the act of giving" and "the act of receiving" respectively. The difference between what was received and given, or vice versa, is called a "balance". A balance might be an amount owed or an amount of apples in a business's inventory.

Once you understand that a "credit" is a generic term for "given" and a "debit" is a generic term for "received", learning to record and interpret financial transactions becomes straightforward. For example, if you borrow money to buy a car, the amount you owe your lender at any time (your balance due) is the amount your lender initially gave you (their credits) minus the amounts they received from you in payments (their debits). Getting used to using the terms debit and credit just requires a bit of practice because they describe something you already know how to do, which in this example was lend (give) and borrow (receive).

I emphasize again that anyone can learn the double-entry bookkeeping system. You can start now by downloading the app on the Apple or Google Play stores. Just search for "Addictive Accounting" or follow the previous links.

Once you understand that a "credit" is a generic term for "given" and a "debit" is a generic term for "received", learning to record and interpret financial transactions becomes straightforward. For example, if you borrow money to buy a car, the amount you owe your lender at any time (your balance due) is the amount your lender initially gave you (their credits) minus the amounts they received from you in payments (their debits). Getting used to using the terms debit and credit just requires a bit of practice because they describe something you already know how to do, which in this example was lend (give) and borrow (receive).

I emphasize again that anyone can learn the double-entry bookkeeping system. You can start now by downloading the app on the Apple or Google Play stores. Just search for "Addictive Accounting" or follow the previous links.

Over 4 Hours of Free Course Content,

No Ads,

and No Personal Data Collected

For iPads, iPhones, and Android phones and tablets

Take a look at what you will learn in the Addictive Accounting course.