Definition: Forensic Accounting

What is Forensic Accounting?

Forensic accounting is the examination of financial records. It is performed with the intent of locating financial evidence that can be used to either prove or disprove someone's assumption. Forensic accounting is a relatively new accounting specialty. A forensic accountant is a specialized accounting auditor. An auditor is someone who specializes in validating accounting records during an audit. An "audit" is the term for a financial investigation which validates financial records with those with whom the business does business with. For example, government agencies hire third-party auditors to audit their financial records on a periodic basis to ensure that their accounting records are complete, accurate, and valid. It is unlikely that a government agency would hire a forensic accounting accountant to do that type of work unless it had a particular need to do so.

A forensic accounting accountant specializes in auditing financial records with an emphasis in criminal law. The primary purpose of hiring a forensic accounting accountant would be to follow a money trail as opposed to just validating accounting records for accuracy. Forensic accounting accountants investigate actions like fraud and money laundering. For example, the Unites States Federal Bureau of Investigations (FBI) and Drug Enforcement Administration (DEA) hire forensic accounting accountants to help follow the money trails of illegal drug activities. These agencies are more interested in investigating how the money flows between individuals and less interested about how well the accounting records are kept. A simple notebook containing account numbers would be an example of something that would be given to a forensic accounting accountant for examination. In a sense, a forensic accounting accountant is a financial forensic detective.

A forensic accounting accountant requires specialized training. If you are interested in becoming a forensic accounting accountant, the best option is to find a post-educational institution that offers a specialty forensic accounting course. However, every forensic accounting expert has to know the foundations of bookkeeping and accounting.

If you want to become a forensic accounting accountant, you certainly can and we can help. The Addictive Accounting interactive textbook was created to help you master the basics of bookkeeping and accounting so that you can ace any accounting course.

A forensic accounting accountant specializes in auditing financial records with an emphasis in criminal law. The primary purpose of hiring a forensic accounting accountant would be to follow a money trail as opposed to just validating accounting records for accuracy. Forensic accounting accountants investigate actions like fraud and money laundering. For example, the Unites States Federal Bureau of Investigations (FBI) and Drug Enforcement Administration (DEA) hire forensic accounting accountants to help follow the money trails of illegal drug activities. These agencies are more interested in investigating how the money flows between individuals and less interested about how well the accounting records are kept. A simple notebook containing account numbers would be an example of something that would be given to a forensic accounting accountant for examination. In a sense, a forensic accounting accountant is a financial forensic detective.

A forensic accounting accountant requires specialized training. If you are interested in becoming a forensic accounting accountant, the best option is to find a post-educational institution that offers a specialty forensic accounting course. However, every forensic accounting expert has to know the foundations of bookkeeping and accounting.

If you want to become a forensic accounting accountant, you certainly can and we can help. The Addictive Accounting interactive textbook was created to help you master the basics of bookkeeping and accounting so that you can ace any accounting course.

Continue Learning in an Interactive-Accounting Textbook

The Addictive Accounting training course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

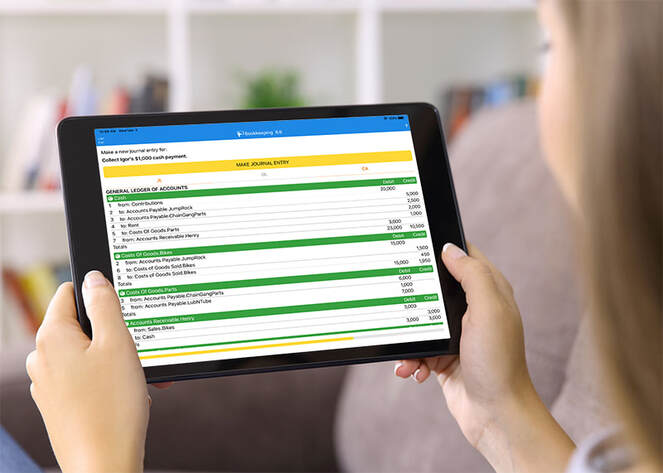

Practice Being a Forensic Accountant in a Simulator

Rather than just read about a forensic accounting, learn and practice forensic accounting in a hands-on accounting simulation. All forensic accountants are proficient in following property transfers which occur by giving and receiving. The acts of giving and receiving are recorded in accounting using debits and credits. Learn more about our accounting simulation app or see what you can learn for free in the Addictive Accounting course.