Definition: Double-Entry Bookkeeping

What is Double-Entry Bookkeeping?

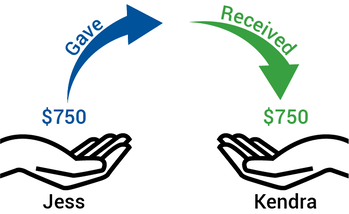

Double-Entry Bookkeeping is the process of recording financial transactions in a Journal in chronological order. Each double entry in the journal is composed of two parts that much equal one another in value. For example, if Jess gave Kendra $750, the double-entry bookkeeping record would record Jess giving $750 and Kendra receiving $570.

Each double-entry bookkeeping record is one part giving (credit) and one part receiving (debit). The bookkeeping term credit means the act of giving and the term debit means the act of receiving.

Double-Entry Journal Entry

Jess gave/credit: $750

Kendra received/debit: $750

Notice that what Jess gave and what Kendra received must always be equal in value because if they were not, something would be unaccounted for.

Gave = Received

$750 = $750 (correct)

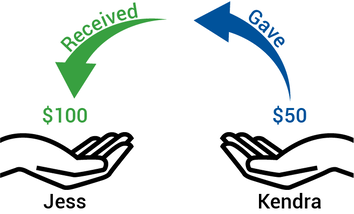

Compare what you just learned with the following figure. What is wrong with it?

Double-Entry Journal Entry

Jess gave/credit: $750

Kendra received/debit: $750

Notice that what Jess gave and what Kendra received must always be equal in value because if they were not, something would be unaccounted for.

Gave = Received

$750 = $750 (correct)

Compare what you just learned with the following figure. What is wrong with it?

Let's write out the double-entry bookkeeping entry.

Double-Entry Journal Entry

Jess received/debit: $100

Kendra gave/credit: $50

Gave = Receive

$100 = $50 (error)

There is clearly a problem because if Kendra gave $100 and Jess only received $50, what happened to the other $50? This would be a double-entry bookkeeping error which is why every journal entry in double-entry bookkeeping always contains two parts that must equal each other.

If you are wondering about the terms debit and credit, "debit" in double-entry bookkeeping means the "act of receiving" and "credit" in double-entry bookkeeping means the "act of giving".

Want to learn more, you can.

Double-Entry Journal Entry

Jess received/debit: $100

Kendra gave/credit: $50

Gave = Receive

$100 = $50 (error)

There is clearly a problem because if Kendra gave $100 and Jess only received $50, what happened to the other $50? This would be a double-entry bookkeeping error which is why every journal entry in double-entry bookkeeping always contains two parts that must equal each other.

If you are wondering about the terms debit and credit, "debit" in double-entry bookkeeping means the "act of receiving" and "credit" in double-entry bookkeeping means the "act of giving".

Want to learn more, you can.

Continue Learning in an Interactive Accounting Textbook

Over 4+ Hours of Free Lessons

The Addictive Accounting training course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

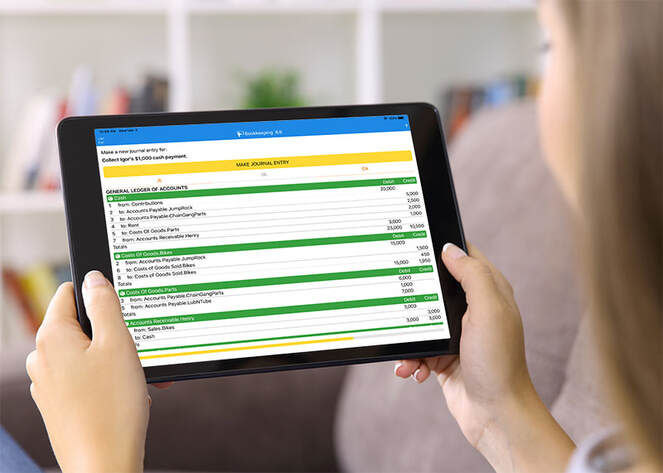

Practice Double-Entry Bookkeeping in a Bookkeeping Simulator

Rather than just read about double-entry bookkeeping, practice double-entry bookkeeping in a hands-on accounting simulation. Learn more about our accounting simulation app and see what you can learn for free in the Addictive Accounting course.