Definition: Accrual Accounting

What is Accrual Accounting?

Accrual accounting uses regular bookkeeping journal entries to record a business's financial transactions. Accrual accounting is unique in that it calculates net profit as all income minus all expenses, independent of whether or not any payment occurred when purchasing or selling. For example, if a business purchased $1,000 of supplies on credit (buy now, pay later) from a wholesaler, the business' accrual accounting net profit would include the $1,000 unpaid supplies expense. The effect of the purchase lowers the business's accrual accounting net profit by $1,000 even though no cash was involved.

The same is true for income in accrual accounting. If a business sells a customer $1,000 of product on credit (customer buys now and pays later), the $1,000 of income from the sale will be included in the accrual accounting net profit calculation. The effect of the sale will increase the accrual accounting net profit $1,000 even though the customer has not actually paid cash for their purchase.

Accrual Accounting Net Profit = All Income - All Expenses

This is why accrual accounting is common referred to as accrual basis accounting. The term "basis" refers to net profit being calculated on an accrual accounting basis. The basis calculation does not relate to how the journal entries are recorded, as all entries in accounting are recorded the same way. It is the interpretation of the entries on net profit that changes according to the basis.

You can think of accrual accounting as a method of calculating net profit independent of cash flow. Since cash is ignored in an accrual accounting net profit calculation, an accrual accounting net profit calculation is nicknamed "paper profits" or "profits on paper." These nicknames reference profits as being potential cash profits. Paper profits become cash profits when income is collected and debts paid with cash. As the saying goes, "you shouldn't count your cash until you actually have it in your hands."

The opposite method to accrual accounting is cash accounting. Cash accounting calculates net profit based on cash payments. Learn more about cash accounting.

Want to learn more, you can.

The same is true for income in accrual accounting. If a business sells a customer $1,000 of product on credit (customer buys now and pays later), the $1,000 of income from the sale will be included in the accrual accounting net profit calculation. The effect of the sale will increase the accrual accounting net profit $1,000 even though the customer has not actually paid cash for their purchase.

Accrual Accounting Net Profit = All Income - All Expenses

This is why accrual accounting is common referred to as accrual basis accounting. The term "basis" refers to net profit being calculated on an accrual accounting basis. The basis calculation does not relate to how the journal entries are recorded, as all entries in accounting are recorded the same way. It is the interpretation of the entries on net profit that changes according to the basis.

You can think of accrual accounting as a method of calculating net profit independent of cash flow. Since cash is ignored in an accrual accounting net profit calculation, an accrual accounting net profit calculation is nicknamed "paper profits" or "profits on paper." These nicknames reference profits as being potential cash profits. Paper profits become cash profits when income is collected and debts paid with cash. As the saying goes, "you shouldn't count your cash until you actually have it in your hands."

The opposite method to accrual accounting is cash accounting. Cash accounting calculates net profit based on cash payments. Learn more about cash accounting.

Want to learn more, you can.

Continue Learning in an Interactive-Accounting Textbook

Over 4+ Hours of Free Lessons

The Addictive Accounting course has a purpose:

To help you quickly master the fundamentals of bookkeeping and accounting!

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

To help you quickly master the fundamentals of bookkeeping and accounting!

- Simplified - created for students and business owners

- Comprehensive - an interactive bookkeeping and accounting textbook

- Practice Make Perfect - in a hands-on bookkeeping simulator

- Learn Finance - cash, profit, equity, and balance statements

- Quiz Yourself - test your comprehension with instant feedback

- Career Boost - communicate finance with confidence

- At Your Pace - complete the course in a week or a weekend

- Teacher's Aid - can be used as an auxiliary tool to enhance learning

- CPA Exam Prep - review fundamentals to greatly improve your score

If you are a student who is planning on studying accounting, or a student who is struggling to learn the concepts, this course is for you. If you want an A grade, take this prep course! If you are business owner who wants to fully understand their personal bookkeeping, this course is also for you.

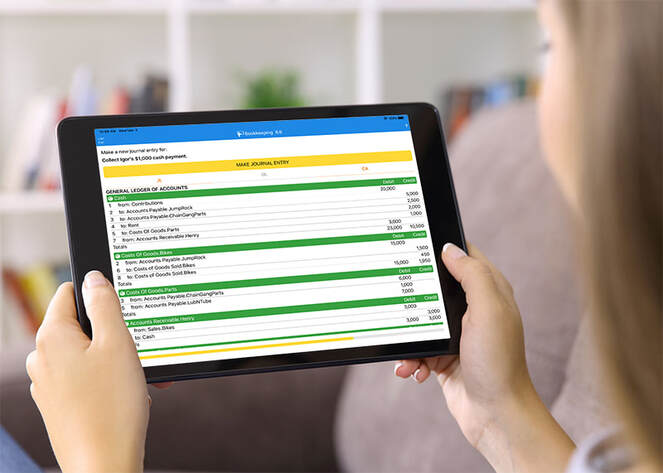

Practice Accrual Accounting in an Accounting Simulator

Rather than just read about accrual accounting, learn and practice accrual and cash accounting in a hands-on accounting simulation. Learn more about our accounting simulation app or see what you can learn for free in the Addictive Accounting course.